The Challenge

A wealth management firm specializing in high-net-worth clients had a significant number of individuals who had started but never completed their investment account applications. Despite offering attractive investment opportunities and having a strong market reputation, the firm was experiencing a high abandonment rate in their client onboarding process.

The firm faced several specific challenges:

- Over 3,200 partial applications submitted over the previous 2 years

- Standard follow-up emails and calls generating minimal response

- Complex application process with multiple steps creating abandonment points

- Regulatory requirements creating friction in the onboarding journey

- Limited understanding of why prospects were abandoning the process

The wealth management firm had essentially written off these partial applications as dead leads, focusing instead on generating new prospects through expensive marketing campaigns and referral programs.

Our Solution

We implemented our commission-based lead reactivation system with zero upfront cost to the wealth management firm. Our approach included:

1. Abandonment Analysis

We conducted detailed analysis to understand why prospects were abandoning applications:

- Identified specific steps in the application process where abandonment occurred

- Analyzed time spent on different sections to identify friction points

- Conducted targeted outreach to understand objections and concerns

- Segmented partial applicants by potential investment amount and profile

2. Compliance-Focused Reactivation Strategy

We developed a reactivation strategy that maintained full regulatory compliance:

- SEC and FINRA-compliant communication templates and frameworks

- Risk-appropriate messaging for different investor profiles

- Privacy-first approach to personal financial information

- Documented consent and preference management

3. High-Touch Reengagement

We implemented a personalized, high-touch approach to reengagement:

- White-glove concierge service to assist with application completion

- Personalized investment opportunities based on initial application data

- Financial education content addressing common concerns

- Simplified application pathways based on abandonment point

- Direct advisor connections for high-value prospects

Implementation Timeline

Compliance Review & Data Analysis

Worked with the firm's compliance team to ensure all reactivation strategies met regulatory requirements. Conducted initial analysis of partial applications to identify patterns.

Prospect Segmentation & Strategy Development

Segmented prospects by investment potential, abandonment stage, and profile. Developed tailored reactivation strategies for each segment.

Content Creation & System Integration

Created compliance-approved content and integrated our systems with the firm's CRM and application platform.

Initial Campaign Launch

Launched phase one of the reactivation campaign focusing on high-potential prospects who had recently abandoned applications.

Mid-Campaign Analysis & Optimization

Analyzed initial results and optimized the approach based on response patterns and conversion data.

Full Campaign Execution

Expanded the campaign to all segments with continuously optimized messaging and approaches.

Final Results & Strategy Recommendations

Delivered comprehensive results and provided strategic recommendations for ongoing application optimization.

The Results

Over the 90-day campaign period, our lead reactivation efforts delivered exceptional results:

Reactivation Metrics

- Total Partial Applications Targeted: 3,246

- Applications Successfully Completed: 746 (23%)

- Average Account Size: $24,800

- Total New Assets Under Management: $18.5 million

- First-Year Management Fee Revenue: $277,500 (1.5% average fee)

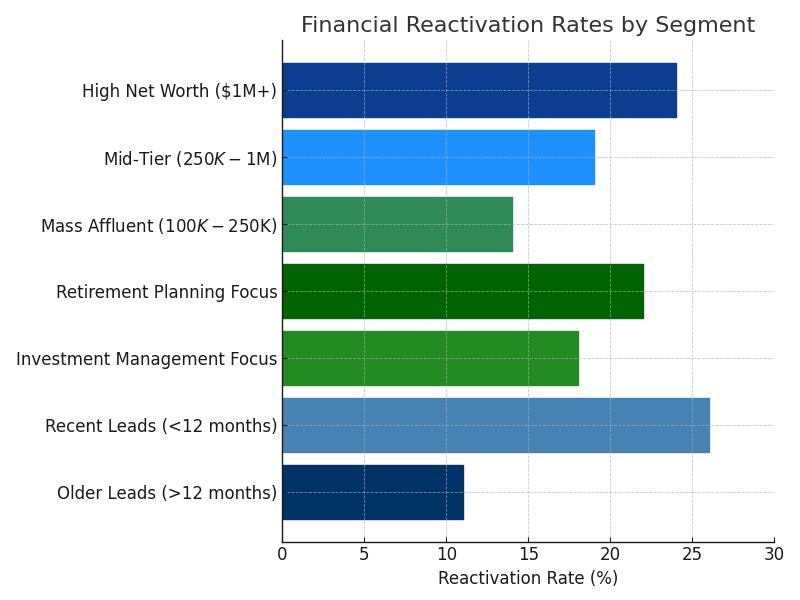

Segment Performance

- High-Net-Worth Segment: 31% completion rate

- Mid-Tier Investors: 26% completion rate

- Early-Stage Investors: 17% completion rate

- Recent Abandonment (< 90 days): 34% completion rate

- Older Abandonment (> 90 days): 19% completion rate

Long-Term Impact

- Lifetime Value: Projected $1.2M in management fees over average client lifespan

- Additional Referrals: 37 new client referrals from reactivated clients within 6 months

- Application Process Improvements: 42% reduction in abandonment rate after implementation of process recommendations

- Client Acquisition Cost: 78% lower than the firm's average CAC for new clients

New assets under management by investor segment

The regulatory complexity of our industry had made us hesitant to aggressively follow up with partial applications. WeProfitWhenYouDo not only created a fully compliant reactivation strategy but delivered results that far exceeded our expectations. Converting these abandoned applications into $18.5M in AUM without any upfront cost to us was remarkable. Even more valuable were the insights into why people were abandoning our applications, which has helped us improve our entire client acquisition process.

Have Uncompleted Applications in Your Pipeline?

Let's discuss how our risk-free lead reactivation process can transform your abandoned applications into valuable clients—with zero upfront investment required.

Start Your Success Story